The Rise of Emerging Managers in Numbers

Looking at the Performance of Emerging and First-Time Venture Capital Funds in Numbers

This is the second article in a series of posts discussing the topic of investments in young venture funds, raised and run by emerging fund managers.

In our first article on emerging managers, we were focussing on the qualitative aspects of the risks and opportunities of young venture funds. But while there is undeniably a case for investing in this asset class, how big are the rewards, and how risky is it really?

In this second article, we want to share the various quantitative insights we have collected in our research (see also references below). There is no ambition to be exhaustive, and much of the data is starting to look a bit old, but we think that Venture Capital has a long-term perspective and the general trend is discernable. (Feel free to suggest data that we overlooked or omitted by sending an email to softduediligence@saintclair.ltd).

Who is an Emerging Fund Manager?

Before we dive into numbers, a quick look at the definition of an Emerging Fund Manager itself, which is quite prone to variations across sources. Parameters are generally a combination of years of activity, number of funds raised and fund sizes.

Pitchbook sets the bar at less than four funds raised, and other definitions seen elsewhere include a vague “newly formed” or “relatively small” in their criteria, leaving the spectrum quite open.

There is obviously a big difference in available track-record between VCs raising Fund I and others already benefitting from the experience of having raised one, two or three previous funds. But just considering the case of an experienced spin-off GP from a mature VC firm raising his first solo fund vs. a relatively recent Venture Capitalist raising Fund II or III, we do not find this criterion that meaningful.

So, at the end of the day, who is an Emerging Fund Manager? In our opinion, it comes down to for whom you represent an Emerging Fund Manager. Being “Emerging” or not is not a label, it is a decision criterion for the people you interact with, in particular prospective LPs.

As an LP, you need to have a focussed investment approach and an effective risk-mitigation strategy. Part of it is a set of criteria creating boundaries between funds you are ready to invest in, and the ones you’re not. This set of criteria will certainly (or should) include the ones cited above, but tailored to the individual requirement and objectives of your own investment portfolio.

For ourselves, unsurprisingly, we would retain a definition that comes more from an entrepreneurial point of view, than one based on numerical data. We would probably consider “Emerging” fund managers those whose activity includes an element of exploration, a quest for ways to push the boundaries. Those could be their own boundaries as fund managers (e.g. starting out in the industry) or the boundaries of the industry itself, with an investment thesis sporting an innovative element (e.g. in the industry focus, geography or demographic).

The other “Emerging”

There is another way a fund manager or a fund is considered “Emerging” in the literature, namely by considering aspects of origin or diversity.

The Venture Capital industry has long been dominated by a very homogeneous demographic, to intentionally oversimplify it, by “white western males” all coming from the same cultural and academic backgrounds.

This produces a negative side-effect coming from similarity biases on venture financing in general. In their academic research, Franke et al. found that VCs look more favourably at founders with a similar social and educational background, and Murnieks et al. found proof that VC fund managers prefer founders who think like themselves.12

One striking example is the topic of female-led Venture Capital funds: according to Pioneerspost3, 90% of female-managed funds had to be considered “Emerging” in 2021, based on the criteria of managing their first or second fund sized below $100m. (See also the underlying study “Women in VC”4)

(Source Study “Women in VC”)

Going beyond the scope of Venture Capital, the same Pioneerspost article cites a study5 that finds that only 1.4% of US based financial assets are managed by diverse-owned firms.

(Source: KNIGHT DIVERSITY OF ASSET MANAGERS RESEARCH SERIES: INDUSTRY)

Emerging Fund Performance

This being said, when looking at Emerging Fund’s performance, there is a clear case not to discriminate against them as a LP, as a matter of fact quite the reverse. In our opinion Emerging Managers have a compelling argument in their favour.

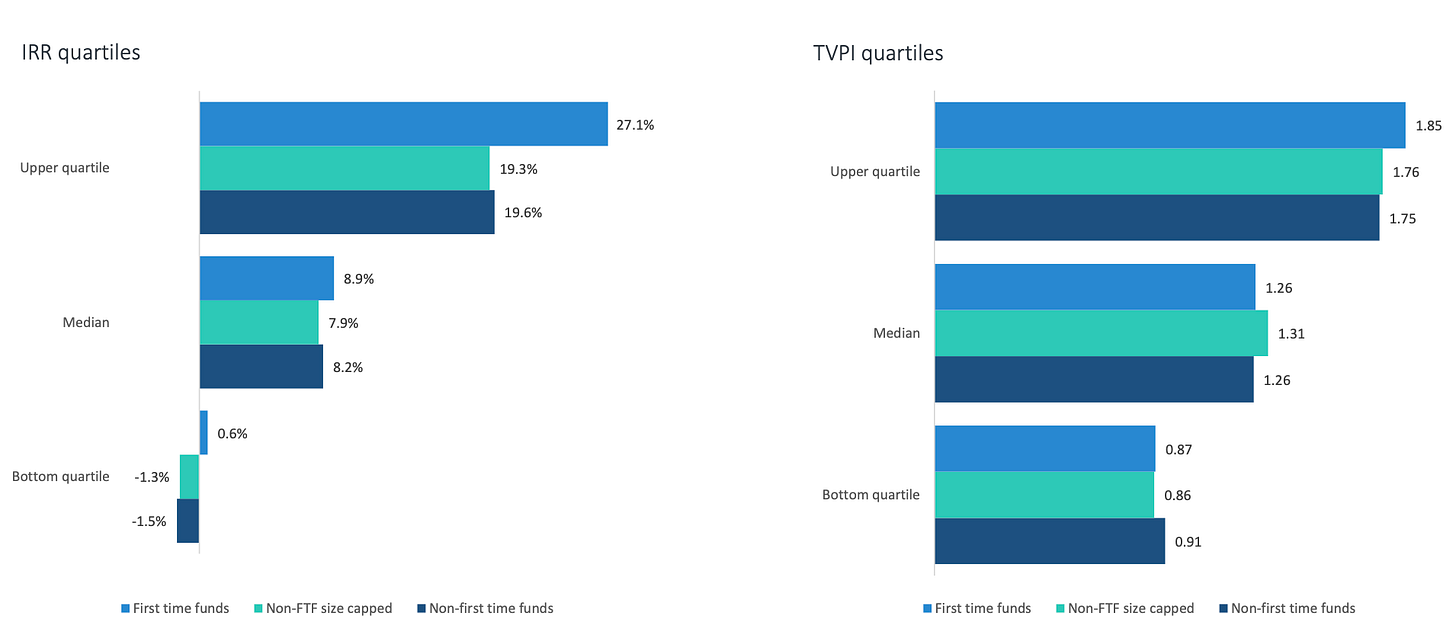

PitchBooks Q1 2021 Benchmarks Report finds that First Time Funds (FTF) significantly outperform “higher number” funds while presenting a lower downside risk.

(Source: PitchBook, 20216)

And this seems to be consistently so: a Prequin report from 2016 states that “First-time funds have outperformed funds of established managers in every year except one (2004) over the past 13 years”7 Again, this data is 7 years old at the time of writing this article, but Venture Capital has a long-term horizon where the underlying internal dynamics do not change.

It would be interesting to see this study updated with more recent data to see how the latest macroeconomic developments might have exercised external influence on first-time and emerging funds. A 2023 study by Vauban for example cites a survey from Venture Capital Journal on LPs willingness to invest in first-time managers.8

The picture is a mixed one: while in 2023 there are significantly more LPs declaring it “less likely” that they would invest in first-time managers, there are fewer that exclude it completely. However, the combined proportion of LPs who responded “more likely” or “just as likely” is larger than in previous years.

This statement by Axios confirms that the dynamics of asset allocations are less favourable to emerging funds: 62% of the capital has gone to 6% of funds, and in Q3 alone, 86.7% of the money was committed to just 66 funds.9

The evolution of global economics in the last 12-24 months, and in particular the rise of the risk-free rate, got the Venture Capital industry into choppy waters. We will dedicate one or our upcoming articles to the particular challenges of being an Emerging Manager in the present times.

The Contribution of Emerging Managers

Looking at how Emerging Managers contribute to the industry as a whole, it appears that they are far from playing a negligible role. According to Cambridge Associates,10 Emerging Managers account for 72 percent of the top returning firms between 2004 and 2016, while receiving a share of allocated capital inferior to more mature funds.

Cambridge Associates situates first-time and emerging funds consistently in the 10 top performers between 2004 and 2016, just like in the Vauban study cited above, where they rank among the 5 top-performers for vintages from 2004 to 2020.

In terms of deal value created, Axios uses Pitchbook data to confirm that emerging Venture Capital firms contribute significantly to the value created by the industry, representing consistently at least 25% over the 10 years leading up to 2022, and up to almost 50% in the peak year of 2017.

Emerging Manager’s future?

Statistical data seems to confirm the case we were making for the benefits of investing in Emerging Managers, our selection of information and sources for this article certainly being prone to a range of biases. However, it looks like we are not alone in thinking that Emerging Managers are to play an important role in the risk-reward game of investing in Venture Capital.

Becoming an Emerging Manager and appearing a credible and trustworthy target for asset allocation is certainly not easy, but at least with the data at hand there is a way to debunk the idea that only the solid track-record and experience of mature VC firms can promise value for LPs.

LPs themselves might want to look more favourably at Emerging Managers and at the potentially outstanding returns they seem to be able to generate. In particular in current times, where allocation of capitals in VC funds are penalised by more compelling alternatives and a low risk-free rate, investing in an emerging fund might be worth considering.

Also, let’s not forget that Emerging Managers are not going to be emerging for ever, an Emerging Manager’s goal is to graduate out of this category and build a successful track-record. For LPs, building a portfolio of Emerging Managers is also creating a pipeline of future - and one day potentially access-restricted - high performing VC funds.

As Rainer Braun, Professor for Entrepreneurial Finance in my Alma Mater TU Munich and Co-Founder of fund of VC funds Equation states: the successful unicorn hunters are the ones that invested at seed stage.

In our next article, we are going to shed some light on the criteria and best practices LPs use to evaluate emerging fund manager and the role and importance of Soft Due Diligence in the process.

Note: The content provided in this article is for informational purposes only and does not constitute financial or investment advice.

Franke, Nikolaus, Gruber, Marc, Harhoff, Dietmar and Henkel, Joachim, (2006), What you are is what you like--similarity biases in venture capitalists' evaluations of start-up teams, Journal of Business Venturing, 21, issue 6, p. 802-826.

Murnieks, C. Y., Haynie, J. M., Wiltbank, R. E., & Harting, T. (2011). ‘I like how you think’: Similarity as an interaction bias in the investor–entrepreneur dyad. Journal of Management Studies, 48(7), 1533–1561. https://doi.org/10.1111/j.1467-6486.2010.00992.x

https://www.pioneerspost.com/news-views/20230125/opinion-emerging-and-diverse-fund-managers-outperform-here-are-five-reasons-why

https://assets.ctfassets.net/jh572x5wd4r0/7qRourAWPj0U9R7MN5nWgy/711a6d8344bcd4fbe0f1a6dcf766a3c0/WVC_Report_-_The_Untapped_Potential_of_Women-Led_Funds.pdf

https://knightfoundation.org/wp-content/uploads/2021/12/KDAM_Industry_2021.pdf

https://files.pitchbook.com/website/files/pdf/Q1_2021_Benchmarks_Webinar_Deck.pdf

http://docs.preqin.com/reports/Preqin-Special-Report-Making-the-Case-for-First-Time-Funds-November-2016.pdf

https://vauban.io/post/lp-for-emerging-fund-managers

https://www.axios.com/newsletters/axios-pro-rata-083a5f20-d970-4827-8870-ddd46338e29c.html?chunk=0&utm_term=emshare#story0

https://www.cambridgeassociates.com/insight/venture-capital-positively-disrupts-intergenerational-investing/